- The Arc

- Posts

- A Crash, Gold, and the Magic of Q4

A Crash, Gold, and the Magic of Q4

Bitcoin is never boring

Photo from the Tetons this past weekend

A lot has happened in the world of bitcoin in the last week. For my audience, it’s worth touching on the main aspects both to keep you informed and to enhance your perspectives as you think about bitcoin.

A Crash

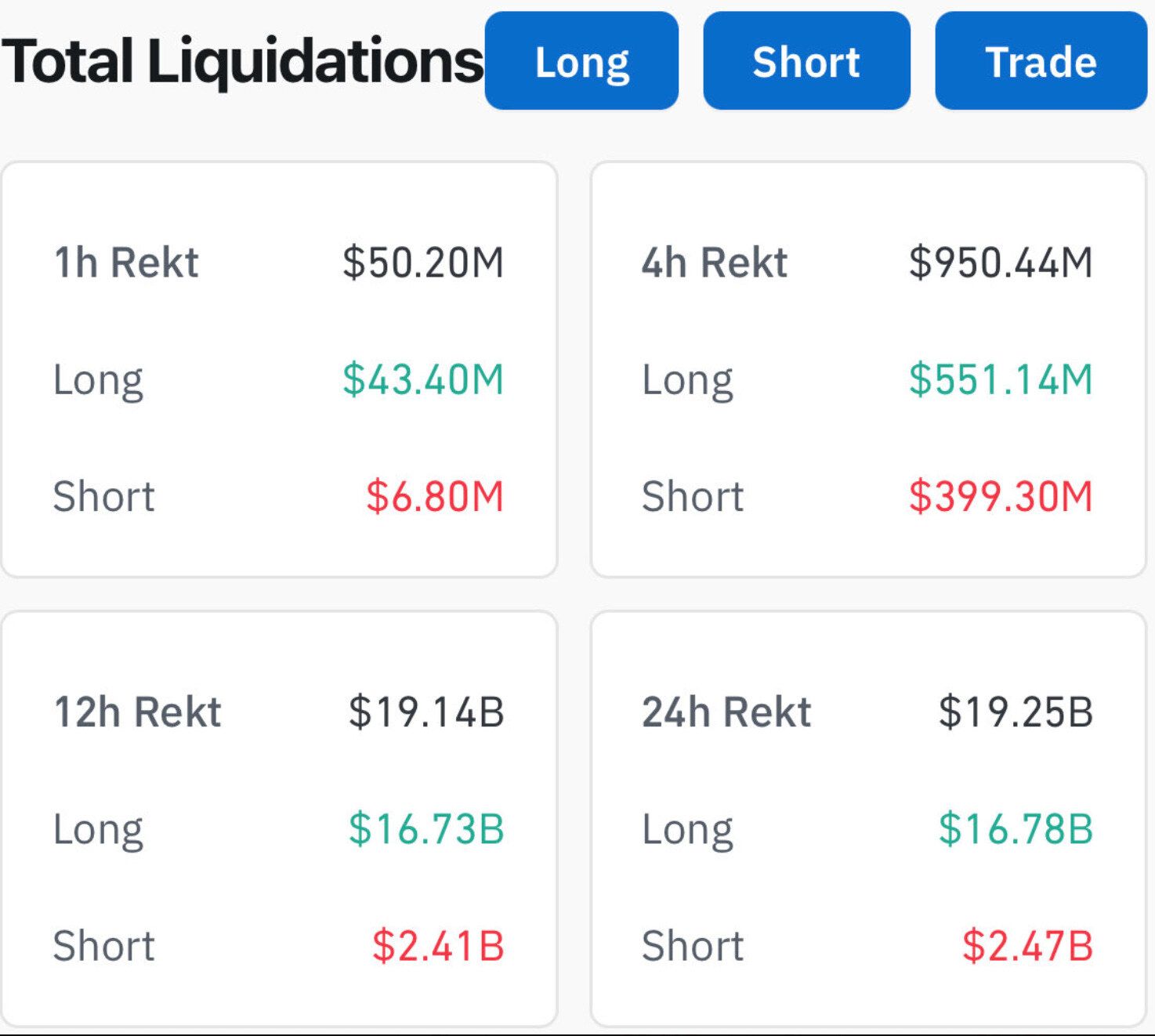

This past Friday, I was in Jackson Hole, Wyoming, celebrating with friends and family, when the worst liquidation event in crypto history occurred. My eyes had never seen how fast many alt coins dropped after the news of China tariffs being levied by President Trump. We watched bitcoin drop from the $120,000s to just under $105,000 in a matter of minutes. At the same time, many prominent alt coins dropped upwards of 60%, something unheard of in this space. $ETH and $SOL both dropped around 20% and that is “mild.” In total, the count of liquidations exceeded $19 billion. For context, when FTX collapsed, there was $1.6 billion lost. COVID caused $1.2 billion in liquidations. This liquidation event was HUGE.

Image from Coinglass

More context, $XRP, the 5th largest alt-coin, crashed to $1.25 from $2.82 in a matter of minutes. $ATOM, a top 25 coin in market cap, dropped to $0.001.

Importantly, this liquidation event brings up once again the potential downfalls of playing with leverage. Spot investors who only buy and hold their assets (speaking specifically to bitcoin) largely saw bitcoin at a price that we saw last week (bitcoin quickly rebounded above $110,000).

My audience is primarily bitcoin only, and this liquidation event mainly impacted alt coins and people who use leverage. These are two things I advocate against; however, the fact that this liquidation event was on the scale it was, at least notationally, and bitcoin didn’t drop below $100,000 is astounding, while also showcasing how much bitcoin has matured since the days of the FTX collapse and Covid.

Again, if you are a bitcoiner and you understand bitcoin, your take on any severe pullback is typically to buy more. Your thesis did not change; your dollar merely purchases more bitcoin. This is the long-term perspective that is needed when you interact with bitcoin.

Gold

After so many years of being seen as “boring,” gold has soared this year. It crossed $4,000 an ounce and approached $4,200. Many people understand gold to be the premier hard asset to hold as a store of value and an inflation hedge. At the same time, we have seen silver reach a new all-time high of above $50 an ounce. My take on these events is that this is merely a worldwide reaction to continued currency debasement.

As Lyn Alden popularized and continues to say, “Nothing stops this train.” The train is the money printer and the debt spiral that we find our country currently in. It is my belief, and the language of the administration proves this, that the United States government will not stop printing money, and if the money printer moves, hard assets will increase in value as your dollar is debased. As your currency is debased, it shows up everywhere in life. Assets and housing increase in price, but so do groceries and daily items. The “winners” in this world are the asset holders, and the losers are people who only have cash. This is undeniable. However, I would argue that holding assets is merely a game to try and preserve your capital at the hands of inflation.

This leads us to gold, and in an ever increasingly digital and global world, it inevitably leads us to bitcoin. Many people are familiar with the properties of gold, and many people are averse to bitcoin, based on what headlines they have heard or do not understand bitcoin at all.

Let’s discuss what makes gold valuable.

Gold has value as a form of “hard money” because it's durable, divisible, fungible, and scarce. It can’t be created at will, it doesn’t corrode and stands the test of time, and people around the world have desired it for thousands of years. Gold also sits outside the financial system and is “censorship resistant.” No intermediary can “freeze” the gold in your possession, and it cannot be created out of thin air.

These are all logical characteristics of why gold has value. Now let’s do bitcoin.

It replicates those same monetary characteristics: scarcity, portability, divisibility, and resistance to debasement in digital form. People who get hung up on the aspect that it is digital need to realize that our current financial rails are all digital (think about the bank app you have on your phone, think about how little cash you have in your wallet). Except, unlike gold, it moves globally near instantaneously and is publicly verifiable. Gold, on the other hand, takes days or weeks to cross oceans and is both very expensive and time-consuming to verify (nation-states have to melt down their gold and test for purity). Bitcoin takes the characteristics gold possesses as a hard form of currency and brings it to the 21st century in a digital way.

So while gold has outperformed this year, I do believe it is a logical consideration to hold that bitcoin has extreme room to grow. The price of bitcoin at gold market cap parity now exceeds $1.3 million per bitcoin.

How does bitcoin get there?

My thesis remains the same as it has been for years. Bitcoin maintains the properties of sound money and also operates under a strict scarcity metric of only 21 million coins. I believe in an ever increasingly digital and global world, and in this belief, it is only logical that bitcoin takes over as the premier store of value and, in doing so, will pass the market cap of gold. I can’t predict when, but I do believe it happens before the year 2032.

Humans have sought hard assets for thousands of years to preserve their capital, and I do not expect that habit to change. Bitcoin is the hardest asset in the world, and I expect it to continue gaining market share. These are characteristics I do not expect to change over the next 50 years and I expect bitcoin to stick around. With that, bitcoin is once again the most asymmetric bet you can make. It either goes to zero or it goes to infinity.

Gold is great, bitcoin is better.

Quarter 4 Magic

Q3 of the year has managed just a 5.75% average performance for bitcoin. Not bad for a span of 3 months, but when you consider the CAGR of bitcoin, this is nothing to hang its hat on. September is also the worst month for bitcoin’s average performance. Q4 is where the fireworks occur.

“Since 2013, Bitcoin has averaged a +85.42% return in Q4, with a median of +52.31% - a figure that better reflects the “typical” quarter once you strip out the outliers. Narrow the window to just the past five years, and those numbers settle to a still-impressive +52.67% average and +47.73% median. And perhaps most telling: since 2013, only four of the twelve Q4s have been negative - implying roughly a two-thirds chance of posting gains in any given year.”

Below are notable year-end predictions made either in 2024 or earlier this year:

Bitwise: Bitcoin above $200,000 (new ATHs for BTC, ETH, and SOL).

Standard Chartered: $135,000 by Q3 2025; $200,000 by year-end.

VanEck: $180,000 by year-end.

Matrixport: $160,000 in 2025.

Galaxy Digital: $150,000 in H1; $185,000 by Q4 2025.

Bernstein: $200,000 by late 2025 or early 2026.

Anything can happen, and I am expecting fireworks.

Worth noting is that it truly seems like every week we are hearing news about more bitcoin adoption. Morgan Stanley has recently expanded its offerings related to bitcoin and other cryptocurrencies, allowing all wealth management clients to access crypto funds, and plans to enable direct trading through its E-Trade platform.

Vanguard, the world’s second-largest asset manager, is also preparing to allow its customers access to crypto ETFs on its brokerage platforms. This comes in stark contrast to a famous statement made by the firm in 2024:

“We also have no plans to offer Vanguard Bitcoin ETFs or other crypto-related products—our perspective is long-standing that cryptocurrencies’ high volatility runs counter to our goal of helping investors generate positive real returns over the long term.”

I believe this move was inevitable. You can’t beat bitcoin, you can only adopt it sooner or later. I also believe this move was inevitable because the current CEO at Vanguard, Salim Ramji has direct experience with BlackRock’s $IBIT ETF, which just became the quickest ETF to $100 billion in AUM (the chart is comical).

All of this to say, conviction has never been stronger.

Stack SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy.