- The Arc

- Posts

- Ego and Timing

Ego and Timing

The price of bitcoin has to be discussed

Three straight weeks and three straight weeks of price discussions. I feel a duty to discuss price because the fear and greed index is the lowest it has ever been.

Yes, lower than 2021 when FTX and other exchanges BLEW UP. I was here in 2021, watching bitcoin crash from 69,000 to around the 18,000 dollar range, and it seemed like bitcoin was dying. I was here in 2020 during the COVID crash, where bitcoin crashed from over $10,000 down to around $3,000 seemingly overnight. I learned two things during both of these events:

1) You can’t kill bitcoin.

2) Going against natural human psychology is extremely hard.

You can’t kill bitcoin, in both those cases, bitcoin bounced back.

In both those cases, had you went against human psychology that tells you not to buy when markets are red, that tells you it could always go lower, you emerged victorious.

already outdated, but meaning remains

I stand before you with the sentiment about the bitcoin price as terrible. 10 days ago, bitcoin was at $108,000. This drop is another 30-40% drop from the all-time high, a pattern typical in cycles, and it has suddenly appeared. The prior drops we have seen in this cycle, this year, were more drawn out. It hurts because of the suddenness the dip has appeared. It hurts because everyone said bitcoin would be over (insert any high number you want, people probably said it) by the end of the year.

It hurts ultimately because bitcoin going down in price today hurts the ego. My ego and yours similarly have an urge to maximize the present moment. Maximizing the present moment appeals to dopamine and doing things to make you feel good. For bitcoin, this means your ego wants your investments to be in the green and for you to feel “right” about your decision to invest.

How your ego makes the dip feel

Your ego struggles to defer present consumption and desires to the future.

However, in moments like these, the future far outweighs anything about today as it relates to your stack of bitcoin. If you are not entirely all in on bitcoin already and have not been swept out in leverage (again, shouting at you not to touch leverage with bitcoin), the prices of bitcoin today are far more attractive than a couple of weeks ago. If you loved bitcoin above $100,000, above $110,000, and above $120,000, you should love bitcoin today, right around $80,000. Prices could always go lower, and that is why I implore a strategy of dollar cost averaging. Some today, some tomorrow, some next week, break up your buys and capture the market volatility. I do believe prices today are a great buy, and if bitcoin goes back to $58,000, I will be saying the same thing. I will be saying the same thing for three reasons:

A cheaper bitcoin price in dollars today means you can trade your fiat, devaluing currency, programmed to inflate, for the scarcest asset in the world. I take that bet 10 out of 10 times.

10 years from now, all that will matter is that you bought. Bitcoin is an asset engineered to transmute physical infrastructure and capital into the digital realm. It is designed to endure, and in an ever-increasingly digital and global world, bitcoin will win.

Conviction is easy in bull markets. When you watch the price go down, your ego forces you to feel. In these moments, education and understanding the fundamentals are key. In these moments, not overleveraging yourself and not relying on short-term price action for your livelihood is key. In these moments, holding a longer time horizon and focusing on the future you want to live is key.

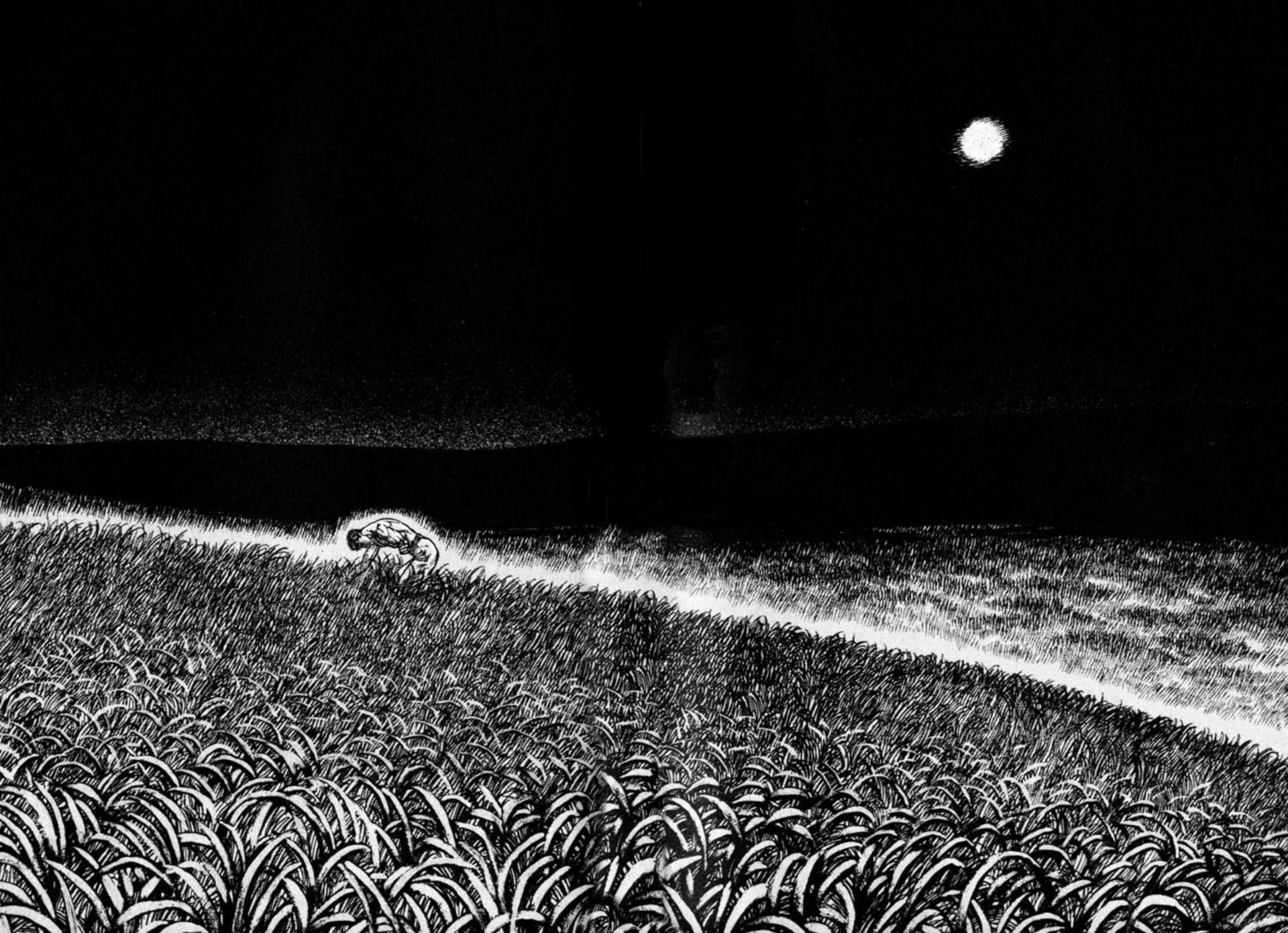

Victors are made in markets where pain is everywhere.

I will finish with 2 quotes from Warren Buffett:

“Be fearful when others are greedy, and be greedy when others are fearful” and

“Buy when there’s blood in the streets, even if the blood is your own.”

He knew a thing or two about markets.

Stacks SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy.