- The Arc

- Posts

- Generational Assets to Save a Generation

Generational Assets to Save a Generation

Bitcoin is our "Real Estate"

$1 million in 1996 equates to $2 million of purchasing power today. As inflation continues, so does your loss of purchasing power. It’s safe to say that as things continue, “Millionaire” status will continue to be less and less meaningful as more millions are needed to satisfy the same standard of living as those who lived decades prior.

Inflation is relevant in this context because I believe there are certain generational tools that have been used to elevate one generation from the prior. Boomers have benefited immensely from cheap housing that has appreciated in value over the years.

This rapid appreciation in real estate value occurred on a linear path since the dollar went off the gold standard in 1971. Since that time, the dollar has lost over 99% of its purchasing power. The winner in the “fiat” world has been hard assets, and for boomers, their real estate was one of the main beneficiaries.

However, this rapid inflation of housing has left many young Americans worse off than their parents, the first generation this has happened. That “starter” home that your parents had is no longer possible for so many people starting their adult lives.

The median home-buyer age just hit 59 years old, up from 39 years in 2010. The average age of first-time homebuyers just hit 40. These are catastrophic numbers for people pursuing the American dream.

The American Dream used to be a young married couple owning a home with a white picket fence in the suburbs where their two to four kids could grow up and play with their friends. Now? The median first-time marriage in the United States is trending close to 30.

Now, this explanation, which answers the question “Why?,” could be a novel, and I am distilling it all into a five-minute read.

I do believe there are multiple reasons why younger people are not getting married and having fewer kids, but I do believe that home ownership and accessibility to affordable housing is a root of the problem. That root of the problem stems from a monetary system that is programmed to go down in value over time. When the money printer does not have an off button, and your currency only has value because society believes it has value, a system where the individual bears the brunt of the impact is perpetual.

In a fiat world, the “winners” are those who have scarce assets because those assets are places where capital can be parked to avoid inflation. I spoke about real estate prices, but the equity markets have also been huge beneficiaries for boomers and older generations. If you had parked money in the S&P 500, not including individual purchases in any of the Magnificent 7 companies, your equity accounts yielded significant returns.

I believe Bitcoin is my generation’s “real estate,” akin to the wealth transfer that the boomers experienced throughout their lives. I believe that holding bitcoin today and for the next decade will enable millions of Americans, and billions of people around the world, to live the lives they want to live.

Housing prices have soared beyond the rate of increase for median incomes.

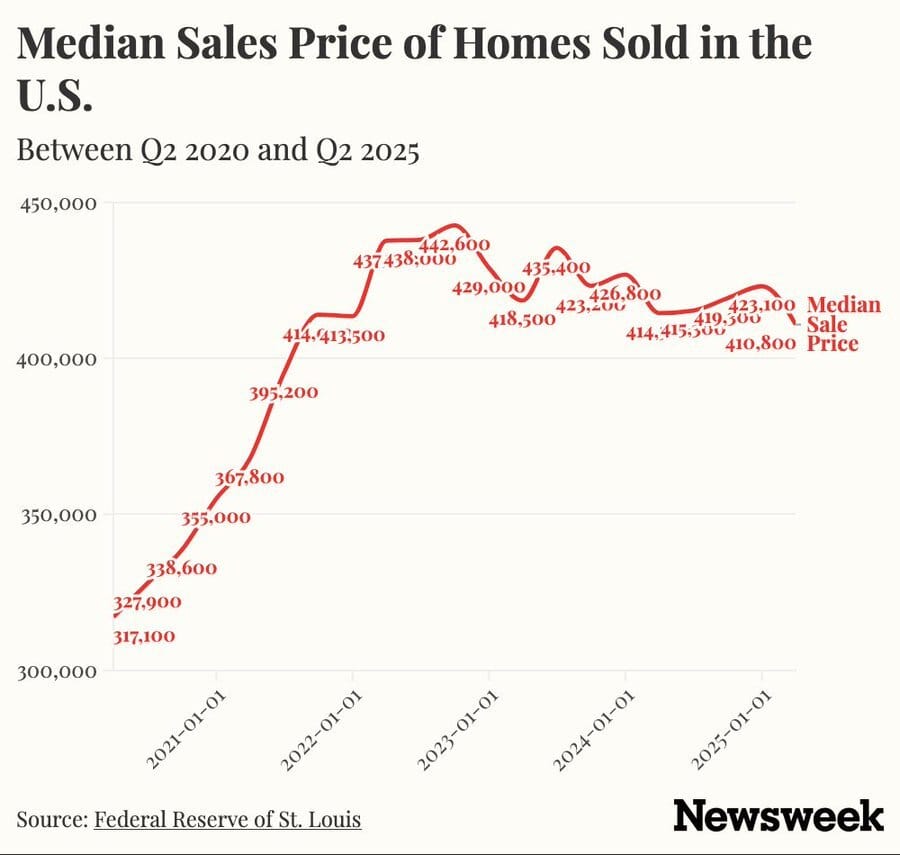

Now look at the median home sale price just since 2020, astounding numbers:

However, when you price homes in bitcoin, homes have become dramatically cheaper. I expect this trend only to continue over the coming years. Homeownership and fulfillment of the American Dream will continue to become more and more accessible to people who hold bitcoin.

Bitcoin is the asset of today’s generation.

Bitcoin is the generational asset to save a generation and to revive the American dream.

Stack SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy.