- The Arc

- Posts

- Pattern Recognition

Pattern Recognition

The Bull Market is Alive

It is hard to zoom out your time perspective when you have nearly unlimited amounts of information at your fingertips with constant notifications and data screaming toward your brain. It is hard not to question if the bull market is dead when we have not seen a parabolic move by bitcoin in recent days.

That sentence alone is a paradox because the timeframe used was “days.” I did not speak in terms of weeks, months, or years. I chose 24 hours. What’s interesting is I cannot think of another asset aside from bitcoin that “days” is a common measure to assess the sentiment about your return on investment. When people think of stocks and other equities, annual performance is typical. Yes, people obviously look at shorter trends, but undeniably, the best mark of performance is on an annual basis.

It is interesting that after 15 years, bitcoin is still fighting the narrative of “getting rich overnight.” With bitcoin having closed above $100,000 for the last ~105 days, it is still wild to me how quickly our brains latch onto new anchoring points and then quickly become “bored” with the performance. If you told me a year ago today that in 2025, bitcoin would close above $100,000 for 100 straight days, that would make me giddy. Yet, here we are, with this a reality, and sentiment across crypto Twitter and the people I speak with is largely “meh.”

Let’s redefine these feelings, zoom out our time horizons, and actually paint the picture for where we are today.

Roughly one year ago today, I published a piece titled “Sideways Action” that had a subtitle of “Bitcoin is boring, embrace the boredom.” The thesis of the piece was the same as today’s writing: Bitcoin consolidates for months at a time, then rips higher to a new leg, then repeats. This is a boring pattern, but it is what happens time and time again.

We are currently in one of those patterns. The fundamentals surrounding bitcoin are as strong as ever. We are just in “one of those boring times.”

More perspective, on September 7th, 2024, I added the below screenshot to my Sideways Action piece.

The 1-year chart of bitcoin looks like this today.

For more context. In 2023, at around this timeframe, bitcoin was ~$26,000. Last year, in 2024, it was ~$54,000. Today, we have been above $100,000 for over 105 days straight.

This compounded growth is crazy!

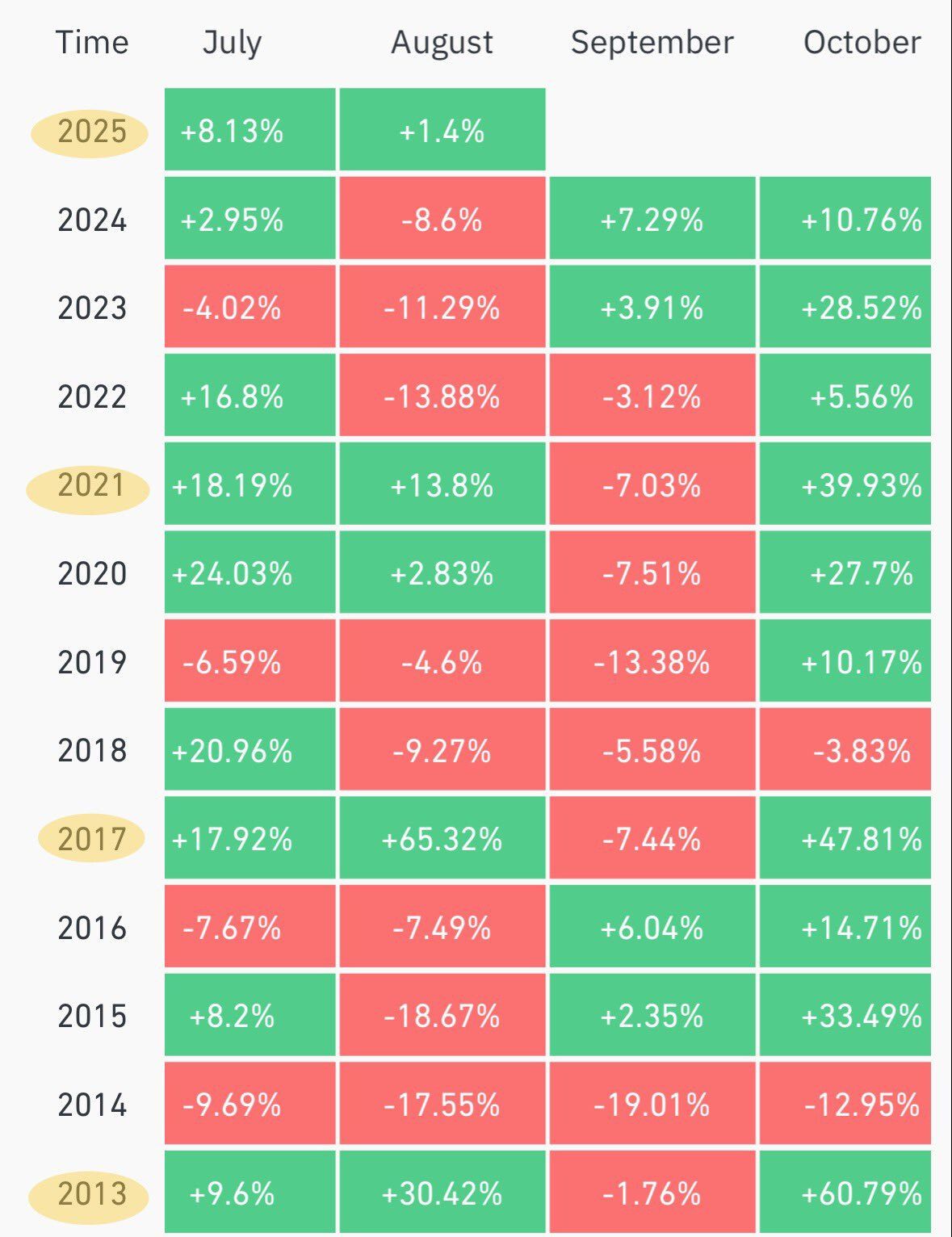

I ended my Sideways Action piece with a discussion on emphasizing that October and November are historically two of the best months for bitcoin price action, while August and September are typically two of the worst. 3 weeks later, on September 28th, 2024, I wrote “Is Uptober Here” and the price of bitcoin was close to $66,000, up over 10% in the month and up over 20% from the month’s lows.

Below is a breakdown of how bitcoin typically performs around these months.

Yes, bitcoin hit a price of over $124,000 in recent weeks and has since cooled off. Yes, it may feel like bitcoin is in limbo and that the bull market is dead. The reality is we are consolidating, and I believe things are just getting started. It’s okay to be “bored” with bitcoin. Zoom out your time horizon and think of the future.

Stack SATs.

The views and opinions expressed here are for entertainment purposes only and should, in no way, be interpreted as financial or investment advice. Always conduct your own research when making an investment or trading decision, as each such move involves risk. Nothing contained in this e-mail/article constitutes, or shall be construed as, an offering of financial instruments, investment advice, or recommendations of an investment strategy.